The FATCA (Foreign Account Tax Compliance Act) compels foreign financial institutions to act as agents of the U.S. Internal Revenue Service and to obtain and report information on behalf of the U.S. Government.

The CRS (Common Reporting Standard) imposes obligations on financial institutions in Hong Kong to review and obtain information in an effort to identify an account holder’s country of residence and provide certain specified account information to the tax administration of Hong Kong.

How to complete the FATCA/CRS during the onboarding procedure?

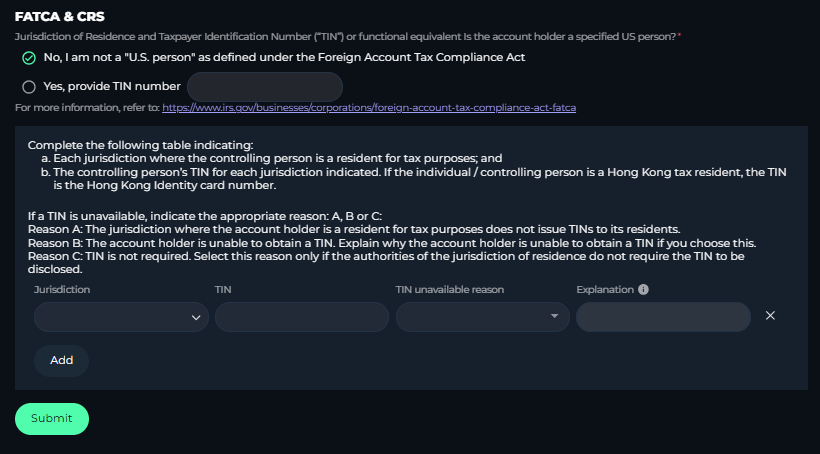

- If you are an individual user on EX.IO, you are required to declare whether you are a US person and required to fill in your tax information (including the TIN number). You can do this during the onboarding procedure by filling out your tax information which looks like this:

- If you are setting a corporate account up, you are required to submit W-8BEN form and Entity Self-Certification Form

What is a TIN number?

A Taxpayer Identification Number (TIN) is an identifying number used for tax purposes in the United States and in other jurisdictions. A TIN can contain letters, numbers, symbols, or a combination of these. Each country defines its own TIN, which can be a National Insurance Number, Social Security Number, Employer Identification Number, or Personal Identification Number.